Term Insurance

Term insurance is a type of life insurance that provides coverage for a specific period, known as the "term," usually ranging from 5 to 30 years. Unlike whole life or universal life insurance, which offer coverage for the entire lifetime of the insured individual, term insurance is designed to offer financial protection for a temporary period when the need for insurance is typically higher.

Here's a closer look at the key features, benefits, and considerations of term insurance.

Features:

Limited Duration: Term insurance offers coverage for a predetermined period, such as 10, 20, or 30 years. Once the term expires, the policyholder needs to renew the policy or let it lapse.

Affordability: Term insurance is generally more affordable than permanent life insurance options. This is because it focuses solely on providing a death benefit without the investment component found in whole or universal life insurance.

Death Benefit: In the event of the policyholder’s death during the term, the beneficiary named in the policy receives a death benefit payout. This payout is usually tax-free and can be used to cover various financial obligations, such as outstanding debts, mortgage payments, education expenses, and daily living costs.

No Cash Value: Unlike permanent life insurance, term insurance does not accumulate a cash value over time. If the policyholder outlives the term, there is no payout or return of premiums paid.

Benefits:

Cost-Effectiveness: Term insurance is an excellent choice for individuals who require substantial coverage but have budget constraints. The premiums are lower compared to permanent policies, making it easier to secure adequate protection.

Flexibility: Term insurance allows policyholders to select the coverage period that aligns with their financial responsibilities. For example, parents may choose a policy that covers their children’s education years.

Focused Coverage: It’s ideal for covering specific financial obligations during a limited period, such as paying off a mortgage, funding college education, or providing income replacement during the working years.

Simplicity: Term insurance is straightforward to understand. There are no complex investment components to grasp, making it an accessible option for those who want simple life insurance coverage.

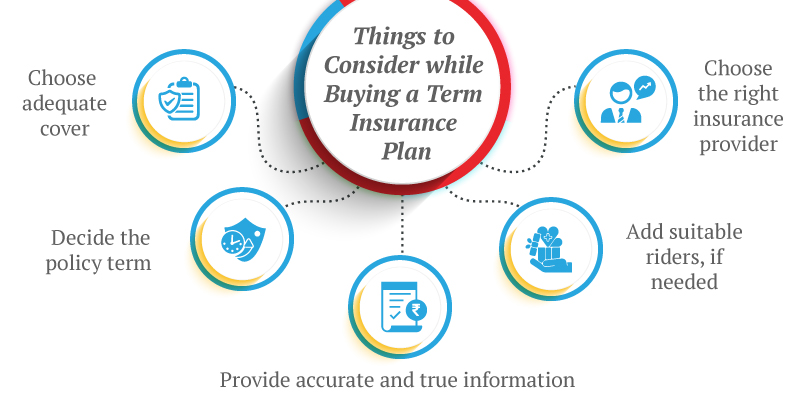

Considerations:

Limited Duration: One of the drawbacks of term insurance is that the coverage is temporary. If the policyholder outlives the term and needs continued coverage, they will have to apply for a new policy, which could come at a higher premium due to age and potential health changes.

No Cash Value: While the absence of a cash value component keeps premiums low, it also means that there is no opportunity for the policyholder to build up savings within the policy.

Premium Increases: Many term insurance policies offer level premiums for the duration of the term. However, some policies might have increasing premiums over time, which can become a concern as the insured ages.

Health Considerations: The cost of premiums and eligibility for term insurance can be influenced by the applicant’s health status. Applicants in poor health might face higher premiums or even denial of coverage.