Money Back Plans

Money back plans are a type of life insurance policy that combines the elements of insurance coverage and periodic payouts of a portion of the sum assured at regular intervals during the policy's term. These plans are popular in India and are designed to provide both financial protection and periodic liquidity to policyholders. Money back plans offer a unique structure that sets them apart from traditional life insurance policies. Here's an overview of money back plans in India:

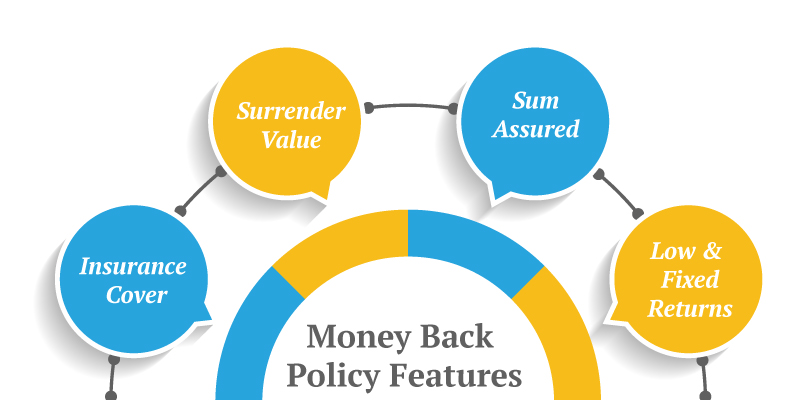

Here's a closer look at the key features, benefits, and considerations of money back plans.

Key Features of Money Back Plans:

Insurance Coverage: Money back plans offer life insurance coverage, ensuring that in case of the policyholder’s demise during the policy term, the nominated beneficiary receives the full sum assured, irrespective of any earlier payouts.

Periodic Payouts: One of the distinctive features of money back plans is the regular payment of a portion of the sum assured at predetermined intervals during the policy term. These payouts, known as “survival benefits” or “money back benefits,” provide policyholders with liquidity at specific intervals.

Maturity Benefit: If the policyholder survives the entire policy term, they receive the remaining sum assured along with any accumulated bonuses or returns as the maturity benefit. This ensures that policyholders receive both periodic payouts and a lump-sum amount at maturity.

Bonus Accrual: Money back plans may also participate in the insurance company’s profit through bonuses. These bonuses can be non-guaranteed and are declared based on the company’s performance. They enhance the overall returns for policyholders.

Flexibility: Money back plans come with various premium payment options, policy terms, and sum assured levels, allowing individuals to choose a plan that aligns with their financial goals and capabilities.

Benefits of Money Back Plans:

Liquidity: The periodic payouts of a portion of the sum assured provide liquidity at regular intervals. This can be helpful for fulfilling short- to medium-term financial needs or goals, such as education expenses or debt repayments.

Insurance Protection: Money back plans offer life insurance coverage, ensuring that the policyholder’s family or beneficiaries are financially protected in case of untimely demise.

Maturity Benefit: At the end of the policy term, policyholders receive the remaining sum assured along with accrued bonuses. This lump-sum payout can be used for various purposes, such as retirement planning or larger financial commitments.

Savings with Insurance: Money back plans combine savings and insurance, making them suitable for individuals looking for a comprehensive financial solution that offers both protection and returns.

Considerations:

Lower Returns: While money back plans offer a combination of insurance and returns, the returns might be lower compared to other investment options due to the insurance component and administrative charges.

Premiums: Premiums for money back plans can be higher than those for term insurance due to the added features and payouts.

Market Performance: The returns on money back plans depend on the insurance company’s performance and the bonuses declared. This can introduce an element of uncertainty into the investment aspect.

Long-Term Commitment: Money back plans usually have a longer-term commitment, and surrendering the policy prematurely might result in lower returns or losses.