Home Insurance

Home insurance in India is a type of insurance that provides financial protection to homeowners against various risks and uncertainties associated with their residential properties. This coverage safeguards homeowners from potential financial losses due to events such as fire, theft, natural disasters, and damage to property and belongings. Home insurance ensures that individuals have a safety net to fall back on in case of unforeseen circumstances that could cause significant financial strain.

Here's an overview of home insurance in India:

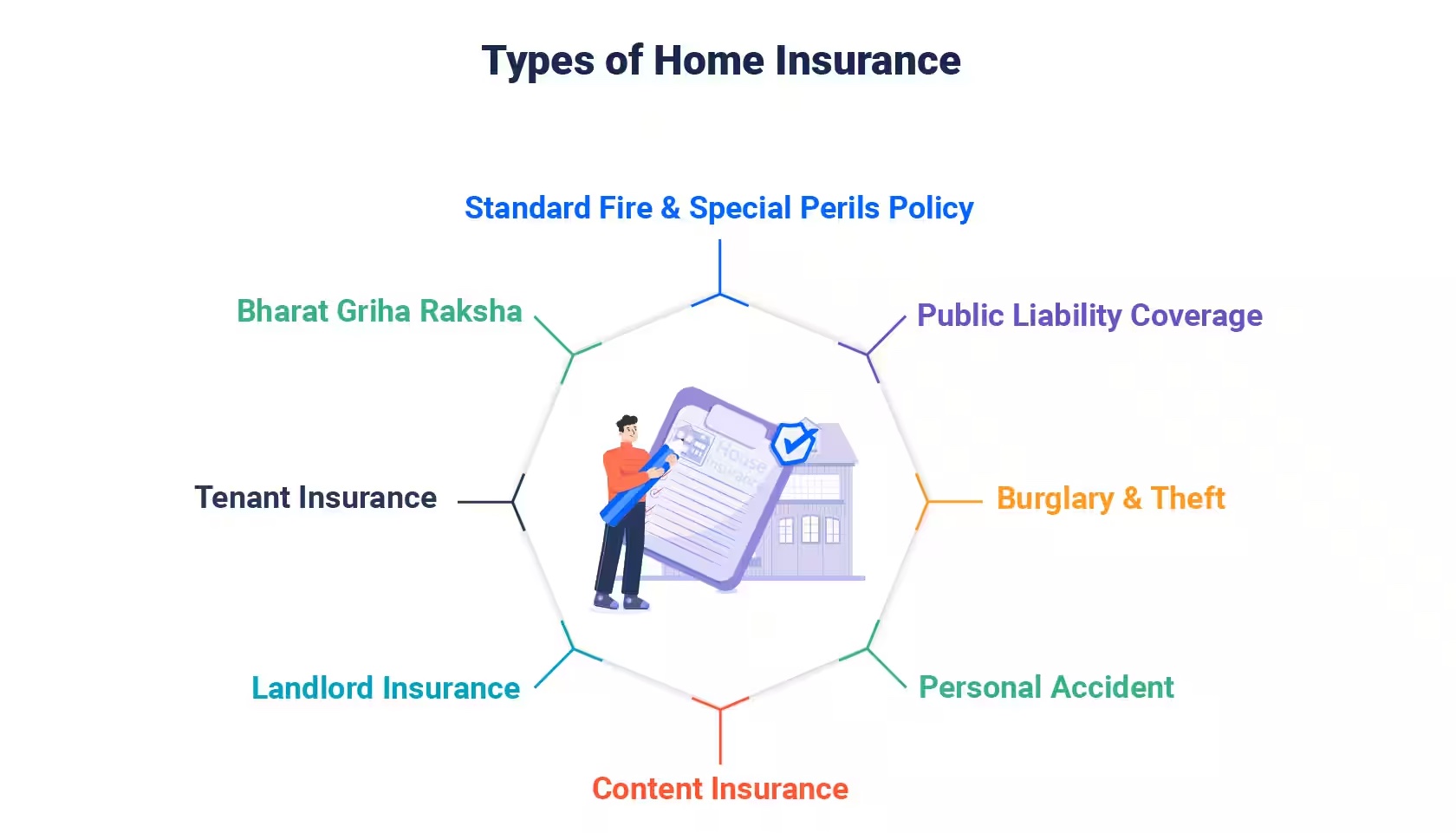

Types of Home Insurance:

Building Insurance: This type of home insurance covers the structure of the property, including the walls, roof, floors, and built-in fixtures. It provides coverage against risks like fire, lightning, earthquakes, floods, storms, and more.

Content Insurance: Content insurance covers the belongings and personal possessions within the home, including furniture, appliances, electronics, jewelry, and other valuables. It protects against risks like theft, burglary, damage, and loss.

Key Features of Home Insurance:

Property Damage: Home insurance covers damage to the structure of the house and its built-in features caused by various perils, including fire, lightning, explosions, natural disasters, and more.

Burglary and Theft: Content insurance protects against losses due to theft, burglary, or damage caused during a break-in.

Liability Coverage: Home insurance often includes personal liability coverage, which protects homeowners against legal liabilities if someone is injured on their property.

Additional Living Expenses: If the insured property becomes uninhabitable due to a covered event, home insurance can provide coverage for temporary living expenses, such as accommodation and meals.

Personal Belongings: Content insurance covers damage or loss of personal belongings within the home, including furniture, appliances, electronics, and other valuables.

Benefits of Home Insurance:

Financial Security: Home insurance provides financial security by covering repair or replacement costs in case of property damage or loss due to covered events.

Property Investment Protection: For many individuals, a home is their most significant investment. Home insurance safeguards this investment against unforeseen events that could lead to significant financial losses.

Peace of Mind: Homeowners can have peace of mind knowing that they are protected against a range of risks, from natural disasters to theft and damage.

Comprehensive Coverage: Home insurance offers comprehensive coverage, addressing both structural damage and loss of personal belongings.

Considerations:

Policy Coverage: Understand the extent of coverage offered by the home insurance policy. Different policies might have varying coverage limits and exclusions.

Valuation: Accurate valuation of the property and its contents is crucial to ensure that you are adequately insured. Underestimating the value could lead to underinsurance.

Premiums: Premiums are determined based on factors such as the property’s location, construction type, coverage type, and value of contents.

Deductibles: Home insurance policies often come with a deductible, which is the portion of the claim amount that the homeowner is responsible for paying.

Claim Process: Familiarize yourself with the claim process and documentation required in case of a covered event. Keep records of your property and possessions for documentation purposes.