Savings Plans

Saving plans in India are financial instruments that combine insurance coverage with an element of savings and investment. These plans offer individuals a structured way to save money for future financial goals while also providing life insurance coverage. Saving plans are designed to cater to individuals' dual needs of wealth accumulation and protection. They come in various forms, offering different features and benefits.

Here's an overview of saving plans in India:

Key Features of Saving Plans:

Insurance Component: Saving plans include a life insurance component, providing a death benefit to the nominee or beneficiary in case of the policyholder’s demise during the policy term. This ensures financial security for the family in the event of an unfortunate event.

Savings and Investment: A portion of the premium paid for saving plans is allocated towards building a savings corpus over time. This corpus accumulates through investments in various instruments, such as bonds, equities, and other financial assets.

Maturity Benefit: At the end of the policy term, if the policyholder survives, they receive the accumulated savings corpus, including bonuses and returns on investments. This lump-sum payout can be used for various financial goals, such as education, retirement, or major expenses.

Flexibility: Saving plans come with different premium payment options, policy terms, and coverage levels, allowing individuals to choose plans that align with their financial objectives and risk tolerance.

Types of Saving Plans:

Endowment Plans: Endowment plans offer a combination of insurance coverage and savings. These plans provide a maturity benefit at the end of the policy term, which includes the sum assured and any accrued bonuses.

Money Back Plans: Money back plans provide periodic payouts of a portion of the sum assured during the policy term. These payouts can be used to fulfill short- to medium-term financial needs, while the remaining sum assured is paid as the maturity benefit.

Unit-Linked Insurance Plans (ULIPs): ULIPs combine investment and insurance components. A portion of the premium is invested in market-linked funds, offering the potential for higher returns. ULIPs provide flexibility in fund choices and allow policyholders to switch between funds.

Child Plans: Child plans are designed to provide for a child’s education and future expenses. They offer a combination of savings and insurance coverage, ensuring that financial goals are met even in the policyholder’s absence.

Benefits of Saving Plans:

Wealth Accumulation: Saving plans provide a disciplined approach to saving and investing, helping individuals build a corpus over time to meet their financial goals.

Insurance Protection: The life insurance component of saving plans ensures that the policyholder’s family is financially protected in case of untimely demise.

Maturity Benefit: The maturity benefit received at the end of the policy term can be used to fulfill various financial aspirations, such as buying a home, funding education, or planning for retirement.

Tax Benefits: Premiums paid for saving plans are eligible for tax benefits under Section 80C of the Income Tax Act. Additionally, the maturity amount received is usually tax-free under Section 10(10D), subject to certain conditions.

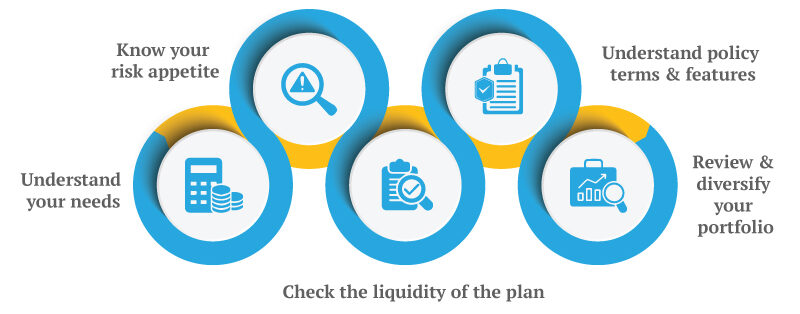

Considerations:

Premiums: Premiums for saving plans can be higher than those for pure insurance policies due to the savings and investment components.

Returns: Returns on saving plans can vary based on the performance of the underlying investments. It’s important to understand the potential returns and associated risks.

Policy Terms: Longer policy terms can yield better returns, but individuals should choose terms that align with their financial goals.

Coverage: While saving plans offer insurance coverage, the sum assured might be lower compared to standalone term insurance policies.