Pension Plans

Pension plans in India play a significant role in ensuring financial security for individuals during their retirement years. These plans are designed to provide a steady income stream to retirees, helping them maintain their quality of life and cover essential expenses even after they have stopped working. Various financial institutions offer different types of pension plans to cater to the diverse needs of the population.

Here, we'll explore the key aspects of pension plans to help you understand their importance and how they work.

Types of Pension Plans in India:

Annuity Plans: Several insurance companies offer annuity plans that allow individuals to invest a lump sum amount and receive regular pension payments. These plans provide flexibility in choosing the annuity options, such as lifetime pensions, joint-life pensions, and more.

- Pension Plans: Pension plans let’s one accumulate a corpus of funds through premiums that one pay’s over a period of time. Upon retirement, one receives regular payments from their corpus to ensure that the expenses can be met and their future is secure.

Benefits and Considerations:

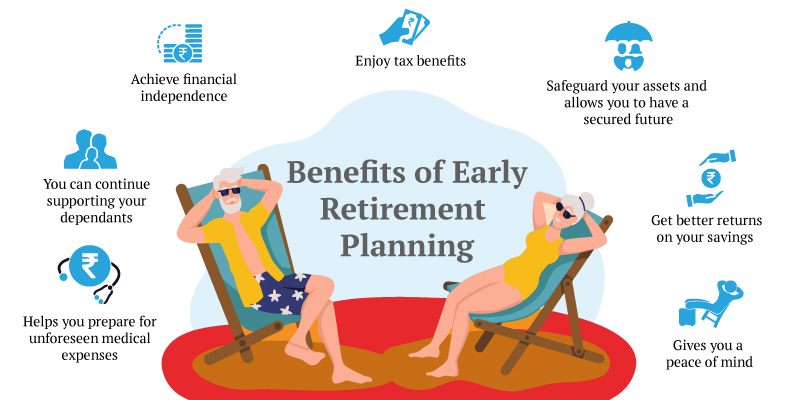

Benefits:

Retirement Security: Pension plans in India provide retirees with a steady income source, ensuring they can maintain their standard of living even after they stop working.

Tax Advantages: Many pension plans offer tax benefits on contributions, interest earned, and withdrawals. This makes them a tax-efficient way to save for retirement.

Diverse Options: Different types of pension plans cater to various segments of the population, ensuring that individuals from various income groups and employment sectors can secure their retirement.

Considerations:

Inflation: While pension plans provide financial security, it’s crucial to consider inflation’s impact on the purchasing power of the pension income over time.

Investment Choices: Plans like NPS and annuity plans offer investment choices, which require individuals to make informed decisions about asset allocation and risk tolerance.

Lock-in Periods: Many pension plans have lock-in periods before which withdrawals are not allowed. It’s important to understand the terms and conditions of the plan before investing.

Changing Needs: As personal circumstances change, individuals should regularly review and adjust their pension plans to ensure they align with their evolving financial goals.