Accidental Insurance

Accidental insurance in India is a specialized type of insurance that provides financial protection to individuals and their families in the event of accidental injuries or death. Accidental insurance policies are designed to offer coverage against the risks and uncertainties associated with unexpected accidents. These policies provide a safety net that helps individuals cope with medical expenses, disabilities, and financial challenges resulting from accidents.

Here's an overview of accidental insurance in India:

Key Features of Accidental Insurance:

Coverage for Accidents: Accidental insurance policies offer coverage against accidental injuries, disabilities, and death caused by unforeseen accidents, regardless of whether they occur at home, at work, or during travel.

Accidental Death Benefit: In case of the insured’s death due to an accident, the policy pays a lump sum amount to the nominee or beneficiary designated by the insured.

Permanent and Total Disability Benefit: If the insured sustains permanent and total disability due to an accident, the policy provides a predefined benefit, helping the insured manage the financial challenges that come with disabilities.

Temporary Total Disability Benefit: Some accidental insurance policies offer coverage for temporary total disabilities, providing compensation for loss of income during the recovery period.

Accidental Medical Expenses: Accidental insurance may cover medical expenses incurred due to accidents, including hospitalization, surgeries, consultations, and more.

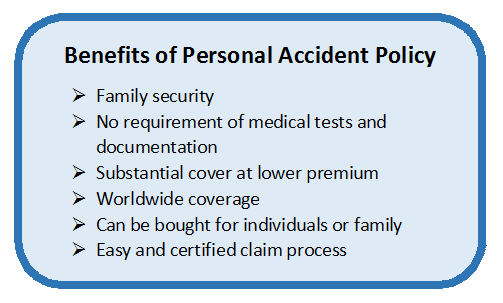

Benefits of Accidental Insurance:

Financial Protection: Accidental insurance provides financial security to individuals and their families in the event of accidental injuries or death. It helps cover medical expenses, treatment costs, and potential loss of income.

Disability Support: Accidents can lead to disabilities that impact an individual’s ability to earn a livelihood. Accidental insurance offers benefits that help individuals cope with the financial challenges of disabilities.

Peace of Mind: Having accidental insurance offers peace of mind, knowing that financial support is available to cover unforeseen expenses resulting from accidents.

Coverage Flexibility: Accidental insurance policies can be customized to suit individual needs and budget, providing options to choose the desired level of coverage.

Considerations:

Coverage Details: Understand the coverage details, terms, and conditions of the accidental insurance policy. Familiarize yourself with the covered events and exclusions.

Beneficiary Designation: Ensure that you have designated the appropriate nominee or beneficiary to receive the benefits in case of accidental death.

Claim Process: Be aware of the claim process and documentation required for filing claims. Keep accurate records of medical bills, hospitalization, and other expenses.

Premiums: Premiums for accidental insurance depend on factors such as age, coverage amount, and the type of coverage chosen.

Complementary Coverage: Accidental insurance can complement other insurance policies such as health insurance, providing additional coverage for accidents.