Critical Illness Insurance

Critical illness insurance in India is a specialized type of insurance that provides financial protection to individuals against the high medical costs associated with specific serious illnesses or medical conditions. This insurance offers coverage for a predefined list of critical illnesses, helping policyholders manage the financial burden that arises from the diagnosis and treatment of these life-altering health conditions. Critical illness insurance is designed to provide a lump-sum payout upon diagnosis of a covered illness, allowing individuals to focus on their recovery without worrying about the financial implications.

Here's an overview of critical illness insurance in India:

Key Features of Critical Illness Insurance:

Covered Illnesses: Critical illness insurance typically covers a predetermined list of serious illnesses, which may include cancer, heart attack, stroke, organ transplant, kidney failure, major surgeries, and more.

Lump-Sum Payout: Upon the diagnosis of a covered critical illness, the policy pays out a lump sum amount to the policyholder. This lump-sum payout can be used to cover medical treatment expenses, lost income, lifestyle adjustments, and other financial needs.

No Requirement of Hospitalization: Critical illness insurance does not necessarily require hospitalization for a claim to be made. Diagnosis of a covered illness is sufficient to trigger the benefit.

Waiting Period: Most critical illness policies have a waiting period from the policy start date before a claim can be made. This period varies depending on the insurance company and the specific illness.

Survival Period: There is usually a survival period requirement, which means that the policyholder must survive for a specified period (e.g., 30 days) after the diagnosis of a covered illness to be eligible for the payout.

Benefits of Critical Illness Insurance:

Financial Protection: Critical illness insurance provides a financial cushion to individuals diagnosed with covered serious illnesses. The lump-sum payout helps cover medical costs, lifestyle adjustments, and other expenses.

Focused Recovery: With the financial burden reduced, individuals can focus on their recovery and treatment without the added stress of managing medical bills and expenses.

Flexibility: The lump-sum payout can be used according to the policyholder’s needs, whether it’s for medical treatments, post-treatment care, or adapting to lifestyle changes.

Support for Dependents: The lump-sum payout can also support dependents and family members during the policyholder’s treatment and recovery period.

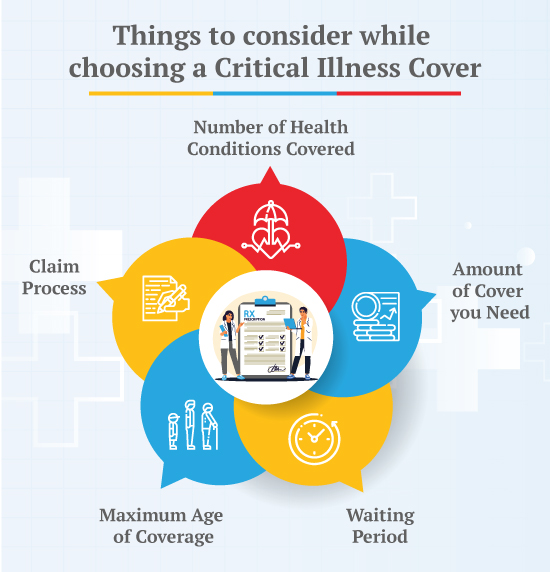

Considerations:

Coverage Details: Understand the critical illnesses covered by the policy, along with the terms and conditions. Different insurance companies may have variations in the list of covered illnesses.

Waiting Period: Be aware of the waiting period requirement before you can make a claim. Some policies may have exclusions during the waiting period.

Survival Period: Understand the survival period requirement, which stipulates the time the insured must survive after the diagnosis for the claim to be valid.

Premiums: Premiums for critical illness insurance depend on factors such as age, sum assured, coverage level, and the specific illnesses covered.

Policy Renewal: Regularly renewing the policy ensures continuous coverage and protection against critical illnesses.